First Class Guaranteed Auto Protection

Financial protection when you need it.

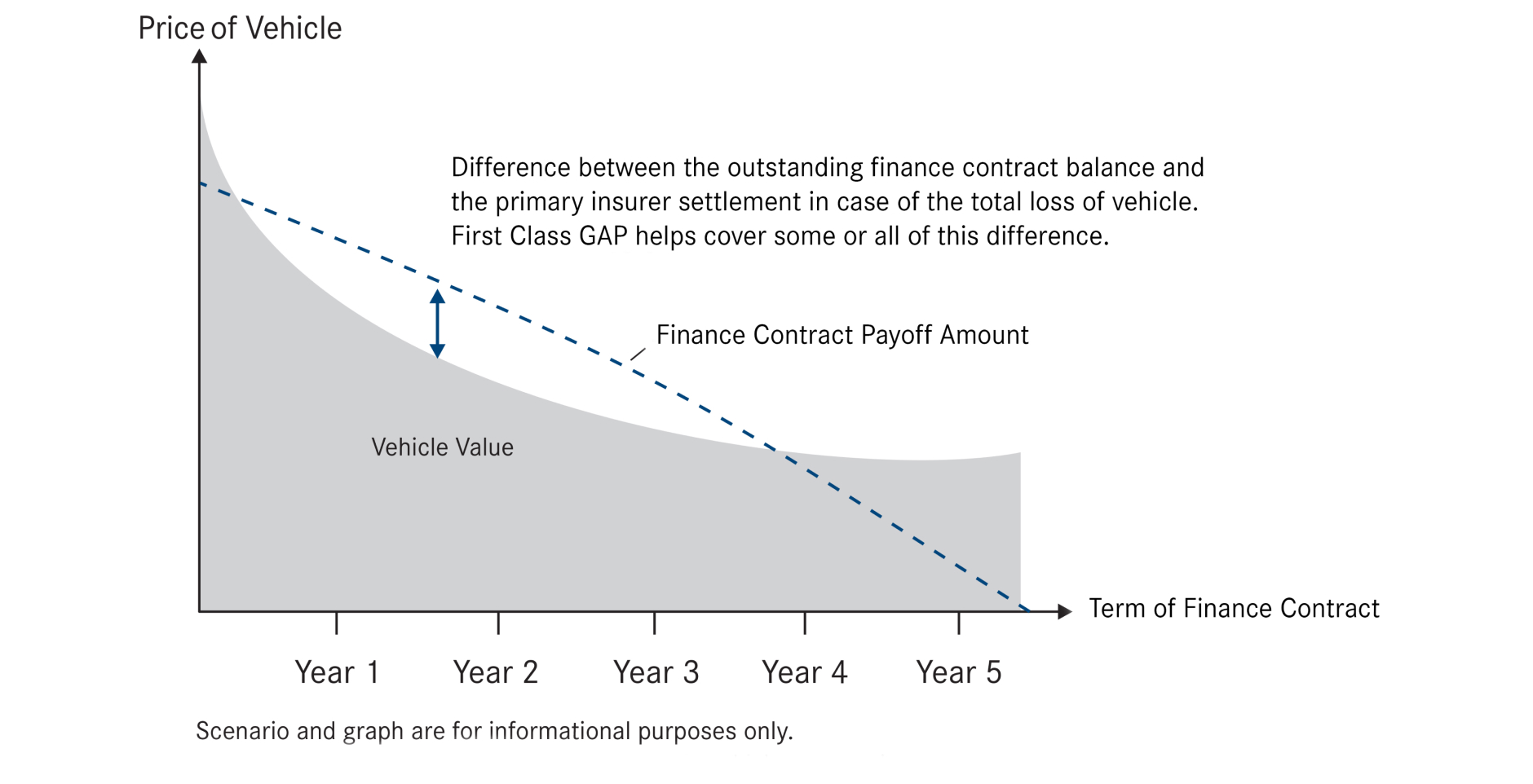

Each year millions of vehicles are totaled in events such as collisions, thefts, or natural disasters. In many cases, the insurance settlement does not cover the finance contract payoff. When you choose First Class Guaranteed Auto Protection (GAP), the GAP Agreement price can be added to your monthly vehicle payment.

Observe First Class Guaranteed Auto Protection Pricing

| Class | Term | Price |

| All Makes and Models, except Sprinter/Metris Vans | 0 - 66 months 67 - 72 months 73 - 84 months |

$820.00 $950.00 $1,060.00 |

Benefits you will find value in.

With the Mercedes-Benz Extended Limited Warranty, you’ll enjoy:

Gain peace of mind with First Class GAP.

If your Mercedes-Benz vehicle is stolen or declared a total loss in an accident, there can be a significant difference between the amount your insurance company will cover and the balance owed to Mercedes-Benz Financial Services. First Class Guaranteed Auto Protection helps cover this difference. Plus, your primary insurance deductible may also be covered up to $1,000 where allowable by state law.

Consider this scenario: You finance $60,000 to purchase a Mercedes-Benz vehicle. Seven months later, you get into an accident that totals your car.

Gain peace of mind with First Class GAP.

$55,000 (Finance contract payoff)

- $50,000 (Insured amount)

$5,000 (The gap)

+ $1,000 (Insurance deductible)

$6,000 (Potential out-of-pocket expense)

- $6,000 (Covered by First Class Guaranteed Auto Protection)

0 (Amount you owe)

In this scenario, the entire difference is covered by First Class GAP. There may be portions of the vehicle finance contract balance for which you remain responsible. See your First Class GAP Agreement for details.

First Class Guaranteed Auto Protection FAQs

Price

This feels like an extra expense—do I really need it?.

We understand; financing a Mercedes-Benz is a significant commitment, and adding costs can be daunting. The GAP plan fee (typically $500–$800, varying by vehicle and term) is a one-time investment that we can fold directly into your monthly payments at no extra interest burden, making it as low as $10–$15 per month. Consider that a total loss shortfall can easily exceed $5,000–$10,000 due to depreciation—far more than the plan's cost. It's proactive financial planning that protects your credit and savings, ensuring you can move on to your next Mercedes without owing thousands out-of-pocket.

GAP insurance is offered by my auto insurer—why pay more through Mercedes-Benz?

Your insurer's GAP might seem cheaper, but it often involves separate applications, higher deductibles, or limitations that don't align with Mercedes-Benz financing terms, potentially leading to claim delays or denials. Our First Class plan is tailored specifically for MBFS contracts, administered by Zurich for reliable processing, and includes seamless integration with dealer support—no third-party hassles. Plus, the deductible reimbursement (up to $1,000) and one-time purchase convenience make it a more comprehensive, worry-free option that matches the luxury standards of your vehicle.

I can get GAP cheaper from a third-party or online provider, so why invest in this GAP plan?

Third-party options might quote lower upfront prices, but they frequently come with hidden fees, stricter eligibility, or incompatibility with MBFS loans, risking denied claims during a stressful time.

Our First Class GAP is optimized for Mercedes-Benz financing, includes the deductible reimbursement perk, and leverages dealer expertise for hassle-free activation—all for a competitive rate when spread over your term. The integrated support and proven track record with luxury vehicles make it a worthwhile choice for true, undivided protection.

What if I trade in or sell before a total loss? Does this go to waste?

Not at all—while GAP is non-refundable and non-transferable to a new vehicle, its value shines in protecting you during ownership, and many customers trade in confidently knowing they're covered against unforeseen events. If you sell privately, the buyer might even value the remaining coverage, indirectly boosting your sale price. In my experience, the low monthly cost (when financed) is a small price for eliminating the risk of a multi-thousand-dollar shortfall, especially since new Mercedes purchases qualify anew—it's about safeguarding this chapter of your driving journey.

Coverage

My comprehensive insurance already covers the full value of my car in a total loss, so why do I need this?

That's a common assumption, but auto insurance payouts are based on the vehicle's actual cash value at the time of loss, which depreciates quickly—often leaving a gap of thousands between that amount and your remaining loan balance. For instance, if you finance a $60,000 model and it's totaled after a year, insurance might pay $45,000, but you could still owe $55,000. First Class GAP bridges that exact difference, plus covers up to $1,000 of your deductible, working hand-in-hand with your policy to eliminate the financial hit and keep your recovery straightforward.

The coverage sounds limited—it only kicks in for total losses, not repairs?

You're spot on; GAP is laser-focused on total loss scenarios (theft, collision, or disaster), not physical repairs—that's what your comprehensive and collision coverage handles. But where it excels is addressing the financial "gap" that insurance alone misses, plus that $1,000 deductible waiver, making the entire claims process less burdensome.

It's a specialized tool in your protection toolkit, complementing other policies efficiently without overlap, and backed by Mercedes-Benz for claims as simple as a phone call to our store.

How do I know this will actually pay out when I need it? What are the fine print exclusions?"

Transparency is key, and the agreement outlines clear eligibility: You must maintain full physical damage insurance, and coverage applies only to covered total losses under your policy. Exclusions like repossession or business use are standard, but Zurich's administration ensures prompt payouts—often within weeks of your insurer's settlement.

We've helped countless owners recover fully, avoiding negative equity headaches. We always review the details with you at signing, so you walk away fully informed and confident in this reliable safeguard.

Practicality

My down payment was large, so the gap between insurance and loan should be small, right?

A solid down payment is smart and reduces the initial loan amount, but rapid depreciation—especially on high-end models—can still create a shortfall. For example, even with 20% down on a $70,000 vehicle, after 12 months, the value might drop to 70% while you owe 85% or more.

GAP accounts for that reality, covering whatever difference arises regardless of your equity position. It's a buffer against market unpredictability, ensuring your financial commitment stays protected and your next steps unburdened.

I plan to pay off my loan quickly or keep the car forever, so total loss isn't a concern for me, right?

Life can throw curveballs like accidents or theft, regardless of your timeline—statistics show over 3 million vehicles are totaled annually in the U.S., and Mercedes models depreciate notably in the first few years. Even with a fast payoff, if a loss happens early, the gap can still sting.

This plan covers you for the full finance term (up to 84 months), providing flexibility and peace of mind without ongoing premiums. Many owners in your position appreciate the "just in case" buffer, ensuring their investment remains secure no matter how long they drive it.

This is only for finance—cash buyers don't need this, do they?

If you're paying cash, there's no loan balance to gap, so it wouldn't apply—but for financed Mercedes (which most owners choose for the flexibility), it's indispensable against the depreciation-insurance mismatch.

Even cash buyers sometimes finance later or lease, and this plan locks in at purchase for those scenarios. For your situation, it's about fortifying against the "what ifs" that could turn a total loss into a financial setback, preserving the joy of Mercedes ownership without the worry of uncovered debts.

Ready to start?

Talk with Mercedes-Benz of Marion about First Class Wheel and Tire Protection and our other vehicle protection and warranty products.

GAP is a product of and administered by Universal Underwriters Service Corporation, an individual member company of Zurich in North America, and is marketed through Mercedes-Benz Financial Services.

The scope of coverage and all transactions related to the optional First Class GAP product are governed solely by the provisions of the applicable product agreement. This webpage provides general information about the optional First Class GAP product and should not be solely relied upon when purchasing coverage. Please refer to your product agreement for details of terms, conditions, and specific coverage details, including limitations, exclusions, transferability and cancelability. Coverage may vary by state. This product may not be available in all states. Requirements for financing GAP may apply based on state law. This product is available at the time of vehicle sale or lease only. Please see your Mercedes-Benz dealer for more information. This is an optional product that is not insurance and is marketed through Mercedes-Benz Financial Services. MBFS NMLS #2546.

84-001-0723 1/24